Date: 19th October 2020

Now that Melbourne is reopening and inspections and auctions are back on the table there are two questions on everyone’s mind,

- Where is the market heading?

- Is 2020 a good year to sell my property?

For some, COVID-19 hasn’t stopped their plans selling and buying throughout the year. For others, they have taken a step back, sitting on the sidelines, waiting and watching to see what happens.

But the question becomes, how long do you wait before you put yourself at a disadvantage?

Consider your needs first

Property is a life decision. Always keep your needs, your lifestyle and your timeline front and centre when looking to sell or buy.

- What are you trying to achieve in selling?

- Do you need more space for a growing family?

- Do you want to live closer to the city? closer to the beach?

- Are you sick of the stairs in your apartment?

& more importantly, what’s the timeline? When will these little niggles become an actual problem for you?

Don’t let the market make your decisions for you, you drive the narrative and timeline in your life.

2020 will be a year unlike others. With travel off the cards for many the usually slow December – January period is set to be bursting with activity. If you’re looking to sell in the next two years there are signs that selling sooner, rather than later, could be an advantage.

If selling is on your agenda, Frank Gordon is here to help. We can provide a confidential, free appraisal in less than 48 hours. In the meantime, we have gathered the latest data, research and trends below to help in your planning and research.

Lower listings = More competition between buyers

The real estate shutdown has created an unprecedented level of pent up buying demand in a period that is normally the busiest season of the year. Put simply, with fewer properties to purchase, buyers need to compete more aggressively for the stock available pushing the price up.

Last month CoreLogic’s Head of Research, Tim Lawless, noted that while housing stock has been lower than average, there is still a strong rate of absorption, which indicates that buyers are still on the market for homes.

Strong buyer demand

According to Property Research Analyst Cameron Kusher from realestate.com.au, demand for property is at record highs. In fact,

- Searches in the buy section of realestate.com.au are 31% compared to the same time last year

- Enquiries on properties listed for sale are up 65% compared to this time last year.

- Our latest listing, 320 Howe Street had 14 private appointments booked in less that 24 hours from listing.

Record low interest rates

Right now interest rates are the lowest they’ve ever been, sitting at around 2.3 percent. Understandably, buyers are happily snapping these rates up. According to the AFR, the value of all housing-related lending rose by a massive 12.6 per cent in August. Looking at the Reserve Bank, they are holding steady. An increase on interest rates won’t be on the horizon until significant progress is made towards their full employment and until they are confident that inflation will be sustainably within the 2-3 per cent band.

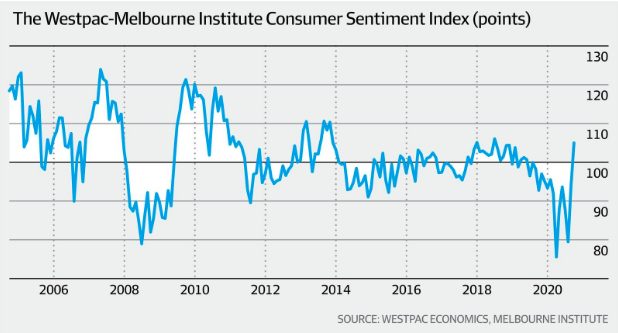

Consumer confidence is rising

The Government is encouraging credit.

In a big move this month, the Federal Government officially removed the responsible lending obligations put in place in 2006. The credit approval process will now be sped up as the loan verification process will be eased for borrowers, and lenders will now face no penalty if borrowers mislead on their loan applications.

This removal of red tape effectively moves us from ‘lender beware’ back towards the traditional ‘borrower beware’ with greater emphasis on self-responsibility of income and expense information being provided by borrowers.

If you’re a regular reader of our news you would know that we have been becoming increasingly worried about the signs of an incoming credit squeeze. This relaxation of regulations should be welcome news to sellers and buyers alike.

Could there be storm clouds ahead?

What we do know is that the banks’ mortgage freeze is expected to end in January 2021 with Job Keeper and Job Seeker simultaneously winding back. This is expected to raise the effective unemployment rate to above 10% causing economic hardship. This hardship could simultaneously reduce the number of buyers in the market while increasing the number of distressed sellers placing properties on the market.

According to CoreLogic’s Head of Research, Tim Lawless, the current low level of advertised properties is helping to insulate home values.

“This could potentially change however as fiscal support starts to taper at the end of September and distressed borrowers taking a repayment holiday reach their six month check-in period around the same time…. If we do see active listing numbers rising to be higher than previous years, it could signal that vendors will need to offer up greater discounts in order to sell their home.”

The bottom line

Right now, interest rates are the lowest they have ever been, there is pent-up buying demand, and strong economic stimulus cushioning job losses. Melbourne still has a long way to go to return to normal, but we are seeing increased activity, in fact we just enjoyed our biggest weekend of auctions in two months, up 218% from the week prior.

Some vendors will wait to see how the sales campaigns go however we do not feel they will be rewarded as much as those who go first.

Selling property can be an incredibly taxing and stressful time, add to that the unpredictability of this year, and we understand it seems a daunting task. We’re here to help and here to support you. The first step in making a decision is bringing together the most up to date information and research you can. Start by requesting a free appraisal here and we can discuss how all of this impacts your property.