So how did the Melbourne property market do in May?

Date: 3rd June 2020

Topic: Melbourne Property Market 2020

There is no question about it, it has been an unprecedented few weeks, but the Melbourne property market has fared a lot better than many were expecting it to in May.

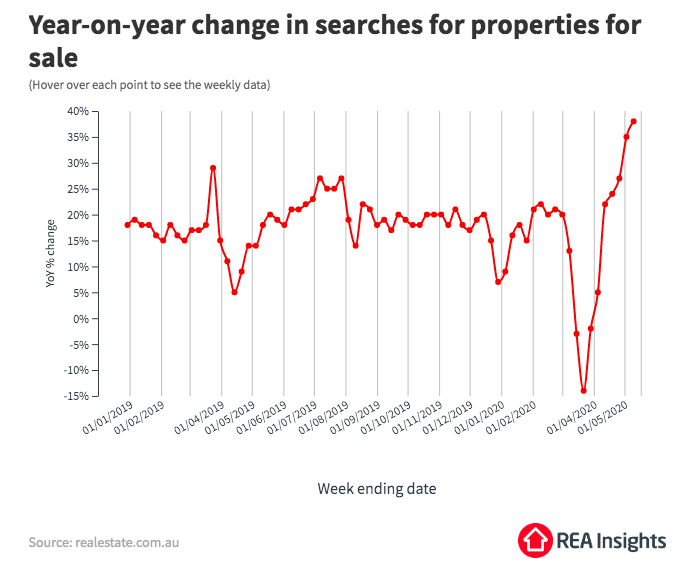

The overall lack of supply has protected prices to an extent. With the return of open homes and public auctions many buyers are heading back online to search for property. Buyer search activity has increased significantly, up 56% on the low levels we experienced in mid-March. That’s 38% higher than the same time last year. All of this leads us to conclude that buyers are following the wider lift in consumer sentiment and if vendors follow suit, it may be a busy few months for property.

Source: realestate.com.au

The big question is, will this boost of activity translate to a growth in transactions?

What does the current market mean for sellers?